This article dives into the range of Safe Harbor Match options, alternatives to the traditional Safe Harbor Match, and how to choose the Safe Harbor design that best fits your goals. NOTE: WE DO NOT SELL YOUR DATA OR EMAIL ADDRESS TO ANY ORGANIZATION.Ģ023 Expert Guide to Safe Harbor Match Options

DC PLAN SAFE HARBOR FREE

To subscribe to our free weekly newsletter, enter your email address below then click the "Join" button.

If you find a broken link or an items that you feel is outdate, irrelevant or no longer appropriate, please let us know.

DC PLAN SAFE HARBOR ARCHIVE

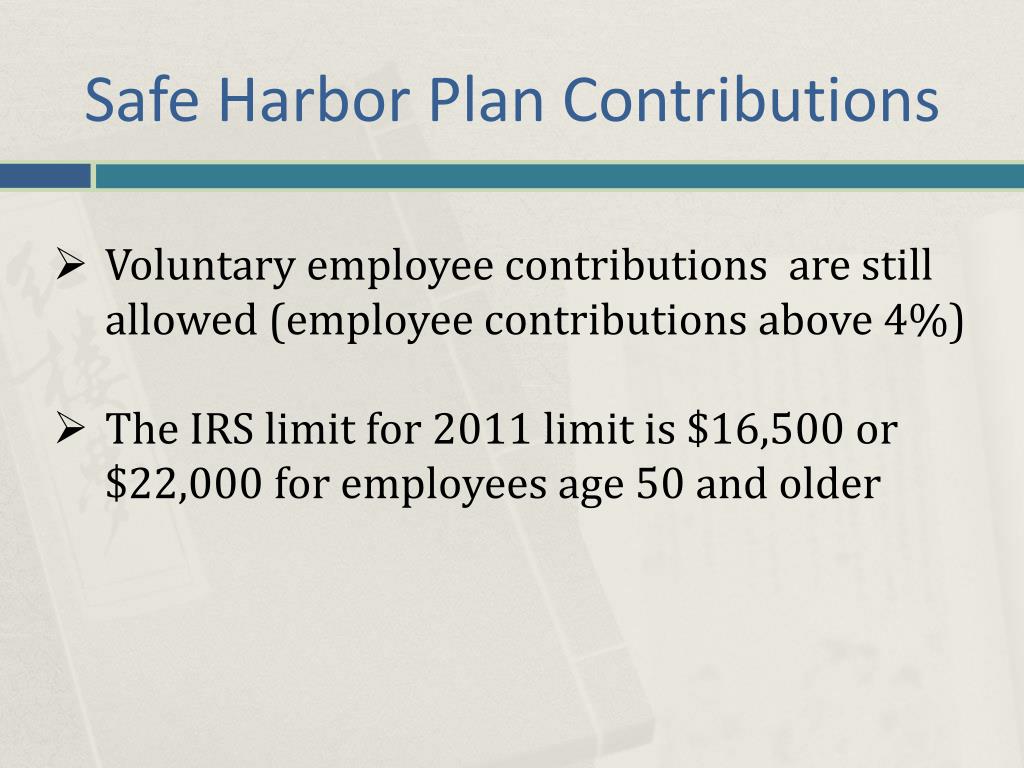

This archive contains not only the most current material on the topic, but also older items that are still relevant, provide background, perspective or are germane to the topic. Here is information to help you understand Safe Harbor 401k plans. 401k plans that adopt one of these alternative methods are referred to as "safe harbor 401k" plans. The Small Business Job Protection Act of 1996 provided 401k plans with alternative, simplified methods of meeting the non-discrimination requirements. Many small businesses find this hard to do and, as a result, many don't set-up such plans. The analysis also tests different assumptions for the share of initial wealth that participants use to purchase these products.COLLECTED WISDOM™ on Safe Harbor 401k Retirement PlansĪs a general rule, 401k plan must satisfy certain non-discrimination requirements.

To address these issues, this paper compares the level of lifetime utility generated by alternative annuitization approaches – immediate annuities, deferred annuities, and additional Social Security through delayed claiming. Moving forward on these fronts would require some consensus about the appropriate share of 401(k) assets to be annuitized and the best method for annuitizing them. This legislation does not address, however, the question of defaults or the possibility of using 401(k) assets to purchase additional Social Security benefits. Recent proposed federal legislation, such as the SECURE Act (Setting Every Community Up for Retirement Enhancement), encourages plan sponsors to offer annuities in their plans by establishing a fiduciary safe harbor when specific statutory conditions are followed in selecting an insurance company. Increasing annuitization in a meaningful way would require embedding annuities in 401(k) plans, with annuitization as the default. And few retirees appear to be deferring claiming in order to receive the maximum annuity income from Social Security – most people simply retire earlier and claim immediately. Very few workers choose to purchase immediate or deferred annuities (the first two options). Right now, none of these three options is commonly used.

Alternatively, they could use their assets to delay claiming Social Security – essentially purchasing an inflation-indexed annuity. Or they could purchase an advanced life deferred annuity (ALDA) that requires a smaller share of accumulated assets and begins payments at a later age like 85. Workers could use a portion of their 401(k) and IRA assets to purchase an immediate annuity that pays a fixed amount throughout their lives, typically starting at age 65. These are difficult decisions.īetter strategies are possible that will ensure a higher level of lifetime income, reduce the likelihood that people will outlive their resources, and alleviate some of the anxiety associated with post-retirement investing. They also must consider how to invest their savings after retirement. Surveys of individuals’ plans and several recent studies suggest that people will not draw down their accumulations for fear that they will exhaust their money and be unable to cover end-of-life health care costs. As a result, retirees have to decide how much to withdraw each year and face the risk of either spending too quickly and outliving their resources or spending too conservatively and consuming too little. Unlike defined benefit pensions that provide participants with steady benefits for as long as they live, 401(k) plans and Individual Retirement Accounts (IRAs) provide little guidance on how to turn accumulated assets into income.

0 kommentar(er)

0 kommentar(er)